To countless global investors, the United States serves as a land of immense opportunity, a destination for creating tomorrow, and a secure setting for their families. However, the path to permanent residency frequently resembles maneuvering through a challenging landscape. This is where the EB-5 Immigrant Investor Program steps in, serving as a reliable compass for those looking to make a meaningful investment in the U.S. economy in exchange for the prestigious copyright. For investors investigating your options for U.S. immigration, this comprehensive guide is created to resolve your queries and clarify the path forward. We will delve into the specifics of the program, from the first steps to the final steps of securing permanent residency, using the framework provided by U.S. Citizenship and Immigration Services (USCIS) to give you the most current and trustworthy information at your disposal.

Main Insights

- The EB-5 investment program delivers a secure path to getting a U.S. copyright through investment, requiring a financial investment of $800,000 in TEA designated regions or $1,050,000 in other areas.

- The procedure requires submitting Form I-526/I-526E, getting a two-year Conditional copyright, and afterward completing Form I-829 to lift conditions.

- Individuals may choose between a managed investment option through a Regional Center or a direct investment strategy.

- Comprehensive records of the lawful source of funds is an essential element that strongly influences favorable application results.

- Individuals applying from heavily impacted nations could encounter waiting periods and need to track the Visa Bulletin for updates on priority dates.

- The program offers a copyright for qualified investors and their family members, with a possible route to U.S. citizenship after five years.

Your Guide to Understanding the EB-5 Investment Visa Program

This EB-5 copyright by investment represents more than a simple visa; it serves as a golden ticket to a fresh start in the United States. Administered by USCIS, the program was established to boost the U.S. economy through investment and employment generation by foreign investors. In return for their contribution, investors, along with their spouses and unmarried children under 21, can secure a copyright, providing them the opportunity to work, live, and study anywhere in the country. This route stands as one of the most trustworthy routes to permanent residency, as it does not require sponsorship from an employer or a family member, delivering a measure of freedom that is highly attractive to global entrepreneurs and investors.

The EB-5 program stands as clear evidence of America's dedication to economic development via international investment. Unlike other immigration pathways that depend on family connections or employment sponsorship, the EB-5 pathway enables investors to direct their immigration destiny through strategic investment placement. This self-directed approach appeals to accomplished entrepreneurs and business leaders who opt to utilize their own monetary assets rather than external sponsors.

Navigating EB-5 Investment Requirements: A Comprehensive Overview

At the heart of the EB-5 program lies the investment component. The required capital contribution isn't necessarily a one-size-fits-all amount; it is determined by the specific area of the business venture you choose to invest in. Grasping these financial requirements represents the first and most critical stage in your EB-5 process. USCIS has implemented two distinct investment levels that reflect the economic development goals of the United States administration.

Understanding the Two Tiers: $800,000 and $1,050,000

An investor must contribute a minimum of $800,000 for investments in ventures situated in a Targeted Employment Area (TEA). Alternatively, the investment requirement rises to $1,050,000 for projects situated outside of these designated areas. These figures are deliberately set; they are carefully calculated to direct investment into regions requiring development, and the difference is significant enough to make the investment location a crucial strategic element.

The investment criteria were determined with deliberate intent to guide foreign capital toward economically disadvantaged regions. The $250,000 difference between TEA and non-TEA investments serves as a substantial incentive that may affect project decisions and overall investment strategy. Investors must carefully evaluate not only the economic factors but also the long-term viability and employment generation prospects of projects in various locations.

Strategic Positioning: Understanding Targeted Employment Areas (TEA)

Understanding a Targeted Employment Area (TEA) is a cornerstone of the EB-5 program. A TEA is defined as either a rural area or a region experiencing high unemployment, namely areas with unemployment rates of at least 150% of the national average. The reduced investment threshold of $800,000 for projects within TEAs acts as a strong inducement designed to direct foreign capital into communities that have the greatest need for economic development and job creation.

When investors consider a TEA-based project, there's more than just reducing the initial investment requirement; these investments can also provide advantages like faster processing times and robust possibilities for fulfilling the program's rigorous job-creation standards. Making the decision about a project within a TEA can therefore be a critical choice that shapes the entire journey of your EB-5 visa copyright submission. Because TEA designations are carefully monitored and continuously revised, it's crucial for investors to confirm present designation before finalizing any project.

Starting Your Path to America: Submitting Form I-526/I-526E

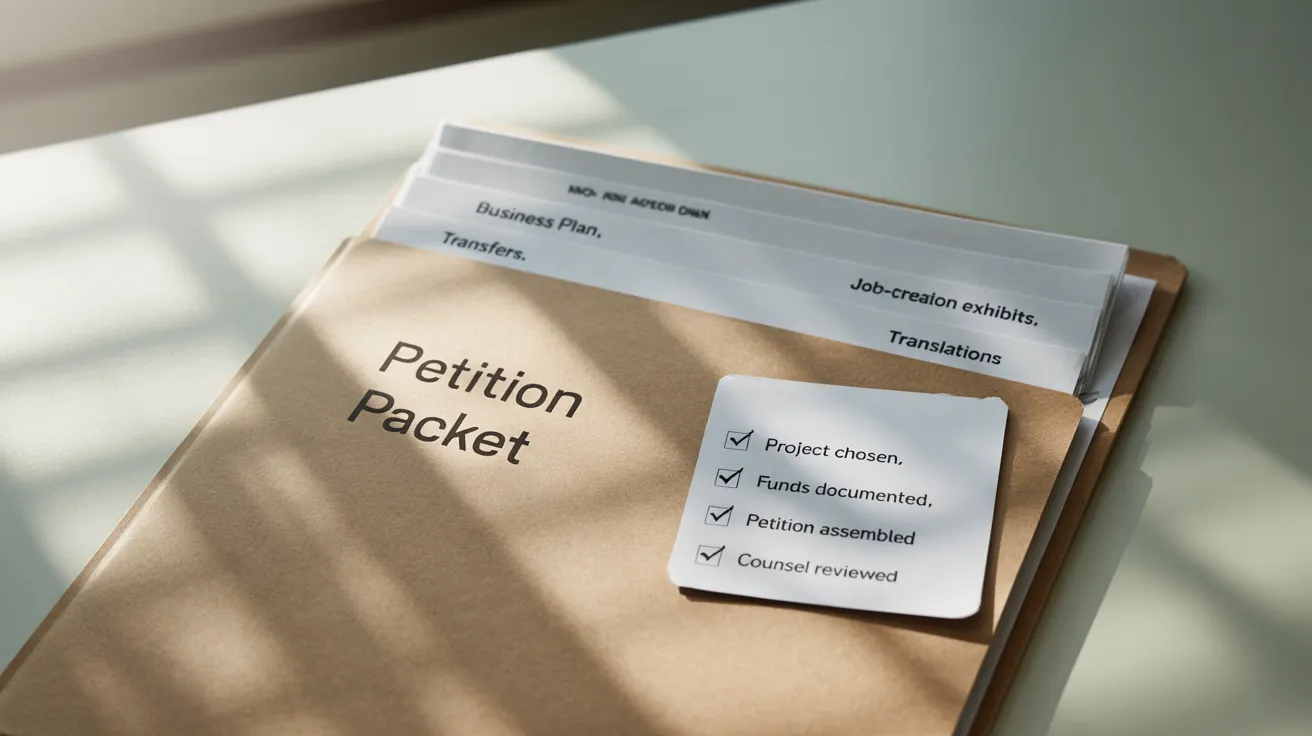

Once you've selected your investment opportunity, the official process for pursuing your EB-5 visa starts with filing Form I-526, or Form I-526E for Regional Center investors. This application to USCIS must thoroughly demonstrate that your investment meets all EB-5 program criteria. This encompasses not only contributing the specified investment capital but also submitting a comprehensive strategy demonstrating how the investment will generate 10 or more full-time employment opportunities for qualified U.S. employees.

The I-526/I-526E petition acts as the basis of your complete EB-5 case. All future stages in the process is contingent on the completeness and accuracy of this initial filing. The filing must showcase a strong business case that proves not only conformity to program requirements but also the sustainability and feasibility of the planned job creation. USCIS adjudicators review these applications with considerable attention to detail, making thorough preparation fundamentally necessary.

Proving Your Legitimacy: The Source of Funds Requirement

A critical part of the I-526/I-526E petition is the documentation of the lawful source of your investment funds. USCIS puts substantial weight on this aspect of the application, and you must present a comprehensive and transparent verification of the source of your capital. This entails submitting extensive financial evidence, namely bank statements, tax returns, and documentation of property sales or other transactions, to create a complete and continuous chain of evidence that your funds were acquired through legal means.

The completeness of your source of funds documentation plays a crucial role in the success of your petition. USCIS demands full tracking of funds from their original source through each financial movement leading to the EB-5 investment. This documentation must account for monetary exchanges, transitional transfers, and any loans or gifts related to building the investment amount. This complex requirement often necessitates collaborating with skilled experts who comprehend the detailed documentation criteria required by USCIS.

The EB-5 Path: Deciding On Regional Center or Direct Investment Approaches

The established EB-5 immigrant investor program provides two unique options for investors: making an investment via a USCIS-approved Regional Center or making a direct investment into a new commercial enterprise. Deciding between these approaches will depend on your personal goals, how involved you want to be, and your risk tolerance. Each option comes with unique benefits and considerations that need to be carefully considered in relation to your individual circumstances and aims.

A Regional Center serves as an economic organization, public or private, that works toward fostering economic development. Regional Centers have gained popularity because they enable a more passive investment approach, consolidating capital from numerous investors and managing the investments for them. Additionally, they offer more flexible job creation requirements, permitting the inclusion of secondary and induced job creation alongside direct employment. This expanded job creation framework can simplify the process of satisfy the program's employment standards.

A direct investment, by comparison, requires a higher degree of participation, wherein the investor is actively involved in managing the enterprise. This route delivers greater control but also calls for a increased amount of management involvement. Direct investments have to prove job creation through direct hiring practices, which can be more challenging but also more clear and demonstrable. The selection between these pathways should align with your approach to investing, time commitment capability, and level of confidence with varying business risk factors.

Navigating the Two-Year Conditional copyright Period

Following approval of your Form I-526/I-526E petition and when a visa is available according to the Visa Bulletin, you and your qualified dependents will be granted a Conditional copyright, valid for a duration of two years. This represents a major milestone, permitting you to reside in the U.S. and start your new life. Yet, as the name indicates, this status is conditional and includes specific requirements that have to be completed to preserve your legal status.

Over this two-year duration, your investment money must remain fully invested and at risk in the project, and the project must proceed towards meeting the job creation specifications. This period acts as a testing period, during which you must demonstrate your continued commitment to the conditions of the EB-5 program. The conditional nature of this standing means that not meeting program conditions can lead to the forfeiture of your copyright and probable removal from the United States.

Having conditional residency status grants most of the benefits of permanent residency, encompassing the ability to travel, work, and utilize certain government services. Nevertheless, the conditional status establishes ongoing regulatory responsibilities that require diligent tracking and record-keeping. Investors are required to maintain thorough records of their capital investment results, job creation metrics, and adherence to residency guidelines throughout the conditional timeframe.

Form I-829: Your Gateway to Permanent Immigration Status

To convert from a conditional resident to a lawful copyright, you need to file Form I-829, the Petition by Investor to Remove Conditions on copyright Status. This petition has to be filed in the 90-day period immediately preceding the two-year anniversary of your entry to the U.S. as a conditional resident. The I-829 petition serves as the final step in proving that you have satisfied all the criteria of the EB-5 program.

It is necessary to provide evidence that your investment continued throughout the two-year provisional term and that the required 10 full-time jobs for U.S. workers were established or preserved through your investment. After approving your I-829 petition, the conditional requirements on your copyright will be lifted, and you will be given unrestricted permanent residency. This indicates the final stage of your EB-5 journey and the attainment of your objective of gaining permanent U.S. residency through investment.

The I-829 submission needs thorough documentation demonstrating conformity to all EB-5 program criteria in the conditional phase. This encompasses financial statements verifying sustained investment, workforce documentation proving job generation, and documentation of the investor's continued involvement in the business. The quality and completeness of these documents directly affects the likelihood of petition approval and the successful removal of conditional status.

The Art of Patience: Navigating Backlogs, Priority Dates, and the Visa Bulletin

For those from countries with high demand for EB-5 visas, like China, India, and Vietnam, the path to securing an investment copyright USA can require a considerable waiting period. This is because of the annual per-country visa quotas established by the U.S. Congress, which limit the amount of visas that can be granted to nationals of any single country at 7% of the total annual allocation for each visa category.

When you lodge your I-526 petition, you receive a "Priority Date," which essentially marks your spot in the processing order. The Visa Bulletin, updated each month by the U.S. Department of State, delivers updates on visa availability and monitors the movement of priority dates for respective country. You have to watch the Visa Bulletin to keep up with the progress of priority dates and to determine when a visa is going to be accessible to you.

As the traditional wisdom tells us, "patience is a virtue," and this rings especially true for EB-5 investors from oversubscribed countries. It is essential to incorporate these potential waiting times into your strategic planning and to understand that the immigration process might span several years from start to finish. An experienced EB-5 visa attorney can offer essential assistance in managing these challenges and creating strategies to navigate the waiting period successfully.

Opening Doors to Success: The Key Benefits and Opportunities in the EB-5 Program

Regardless of the strict prerequisites and potential waiting periods, the EB-5 program provides abundant opportunities that make it a highly sought-after immigration avenue. The primary benefit is the chance for the investor, their spouse, and their unmarried children under 21 to secure permanent residency in the United States. This enables endless opportunities, including the right to live, work, and pursue education across in the country without the need for a sponsor.

The EB-5 program offers unmatched adaptability versus other immigration pathways. Different from employment-based visas that bind you to a specific workplace or area, the EB-5 copyright enables total geographic and professional freedom. You're free to establish a company, transition careers, or pursue education without immigration limitations. This freedom is notably beneficial for business owners and professionals who prioritize freedom and adaptability in their career paths.

Moreover, after holding permanent residency for five years, EB-5 investors and their loved ones may qualify to apply for U.S. citizenship, completing their transition from investor to American citizen. The process to citizenship through EB-5 is uncomplicated, requiring only the continuation of copyright status and adherence to standard naturalization requirements. This marks the final realization of the American dream for many international investors and their loved ones.

Popular Questions

What you need to know about the EB-5 copyright process?

The EB-5 copyright process is a multi-step journey for international investors to secure lawful copyright in the United States. The process starts with identifying a qualifying EB-5 project, either a direct investment or through a Regional Center. The investor then files I-526 or I-526E paperwork with USCIS, submitting detailed documentation of their investment and the lawful source of their funds. After USCIS approval and visa availability, the investor and their family receive a two-year Conditional copyright. In this timeframe, investors must maintain their investment and generate at least 10 U.S. jobs. Ultimately, investors submit Form I-829 to remove the conditions on their copyright and obtain unrestricted copyright.

What investment amount do I need for EB-5?

The baseline investment threshold for the EB-5 program is set at $800,000 for projects established in a Targeted Employment Area (TEA). A TEA is defined as either a rural area or a region with high unemployment. For developments beyond a TEA, the required investment amount reaches $1,050,000. These figures are determined by USCIS and are an essential consideration in an investor's decision-making process. The investment must be sustained at risk throughout the conditional residency period and must be sourced from lawful means with full documentation.

What defines a Targeted Employment Area (TEA)?

A Targeted Employment Area (TEA) is a geographic area designated by USCIS that is classified as either a rural region or an area with unemployment rates reaching at least 150% of the national average. The goal of this designation is to encourage investment in regions of the country that are most in need. Investing in a TEA-based project permits an EB-5 investor to qualify for the lower investment requirement of $800,000. TEA status are determined on particular economic and geographic requirements and are updated on a regular basis to account for shifting economic conditions.

What distinguishes a Regional Center from a direct investment?

Investors more info pursuing EB-5 visas have two options for two investment models: a Regional Center or a direct investment. A Regional Center functions as a USCIS-sanctioned body managing investment projects and pools capital from multiple investors. This approach offers a hands-off investment strategy, as the Regional Center oversees the day-to-day management and job creation requirements. Regional Centers are able to include indirect and induced jobs toward the employment requirement. A direct investment is a more hands-on approach where the investor takes direct control of the business operations. This option provides greater authority while demanding more operational responsibility from the investor and must solely rely on direct jobs toward the employment requirement.

What is a Conditional copyright?

The Conditional copyright serves as a temporary, two-year residency permit granted to EB-5 investors when their I-526 petition is approved and visa numbers become available. It enables the investor and qualifying family members to live and work in the U.S. However, the status is temporary subject to the investor fulfilling all EB-5 program requirements, including sustaining their investment and creating the mandated number of jobs. To transition to permanent residency, the investor needs to file Form I-829 before the conditional period ends. Missing the filing deadline or satisfy program requirements can result in revocation of status and removal from the United States.